Wavestone is helping a pharmaceutical giant industrialize its merger & acquisition processes

In recent years, the pharmaceutical industry in France has seen a great many mergers and acquisitions. The new strategic challenges of reorganization, optimization, and performance brought on by the COVID-19 pandemic have ultimately driven pharmaceutical companies to undertake even more M&A operations.

Mergers between multinationals and small emerging companies offer real opportunities for external growth. They also offer industry players a way to broaden their product portfolio, acquire and develop new technologies or know-how, and position themselves in new innovative markets. The latest such maneuvers by players in the industry have given rise to a phenomenon whereby they have gradually developed a more uniform profile.

The challenge of industrializing the activities & processes of a leader in the sector

Against this background—and as part of its strategic plan—one of the world’s leading human health biopharmaceutical companies set about a transformation program. The challenge? To organize its activities and product portfolio in order to optimize IT-related costs. The objective is to seize strategic opportunities and maintain a competitive leadership position in the market by exploring options for external growth. This led the group’s IT department to call in Wavestone to help standardize and industrialize its activities and processes related to mergers, acquisitions, and divestitures. Their ambition is clear: to establish a common framework for carrying out M&A (Mergers and Acquisitions) operations and international growth projects in order to standardize practices and processes, share a common methodology for conducting M&A programs and for training teams internally.

Message from the CEO

at a seminar in 2016

Reorganizing and optimizing our portfolio is one of our four strategic priorities.

Working alongside the client, Wavestone took on three major challenges:

- Consolidate and standardize the practices and know-how put in place internally and by several external partners

- Establish an end-to-end methodology for M&A projects (step by step, job sheet by job sheet, and process by process)

- Industrialize the activities and processes related to mergers, acquisitions, and divestitures by disseminating a shared methodology and getting the teams on board with the implemented processes and practices

A successful mission facilitated by seamless support from Wavestone

Romain Gagliardi

Program Director

When mergers, acquisitions, divestitures, or partnerships take place, there is usually a lot of pressure to decide and act quickly. There is little or no margin for error, much uncharted territory, and likely some cultural tensions. We wanted to put our client in the optimal position to conduct negotiations and implement action plans so they can derive all the expected benefits from such deals.

Wavestone responded to the challenges of ensuring optimization and efficiency by drawing up a methodological guide for managing mergers, acquisitions, divestitures, and international growth programs. This included:

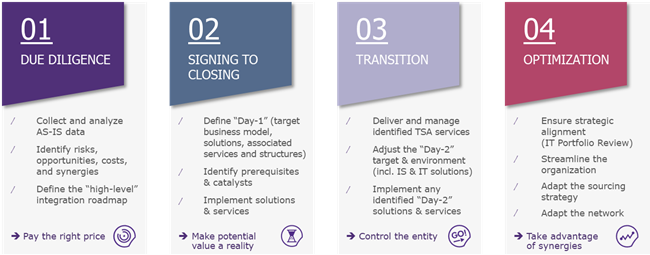

- Drafting a description of all M&A phases (due diligence, signing to closing, transition, optimization) and the related processes and activities

- Establishing the associated governance models and job descriptions (program manager, program PMO, etc.) to facilitate decision making and project monitoring

- Creating the templates and tools needed to manage and coordinate the execution of activities in each phase of M&A operations

The M&A methodological guide was drawn up through an iterative process, with an objective of continuous improvement. That way, as soon as a version of the document was finalized and published, it was used in training to gather the participants’ feedback for incorporation into a subsequent version.

The methodological guide compiles all the key orientations of M&A programs, as well as best practices to adopt, and helps control transformations over time by leveraging strategic investments. While capitalizing on what is already in place, it also brings the client real added value by optimizing and industrializing the processes involved.

But we still need to provide change management and make sure the relevant users make the guide their own. To that end, Wavestone created several training modules with levels of granularity that vary according to the target audience and their objectives. Several workshops and webinars have been held in France and abroad to make the teams aware of the program and illustrate the methodology with real-life cases and scenarios. With a positive and collaborative approach, those modules have also provided valuable feedback that we have used to refine the message and ensure that the teams’ skills are enhanced.

Our expertise

- Due diligence (strategic, corporate, technological) Flash audit upstream of the closing phases or during project execution

- Framing the M&A transition Detailed program framework, including AS-IS and TO-BE analyses, and drawing up the transition plan

- Implementing the M&A transition Managing the transition plan as Program Director and contributing expertise on M&A operations

- Ad-hoc M&A expertise Providing expertise throughout the various phases (transition service agreement (TSA), program governance, technological expertise) or on a specific type of deal (e.g. carve outs & divestitures, joint-venture agreements, etc.)

- Industrializing mergers & acquisitions, divestitures, and joint ventures Forming and rolling out tailor-made methodologies to manage operations of this kind with an industrialized approach