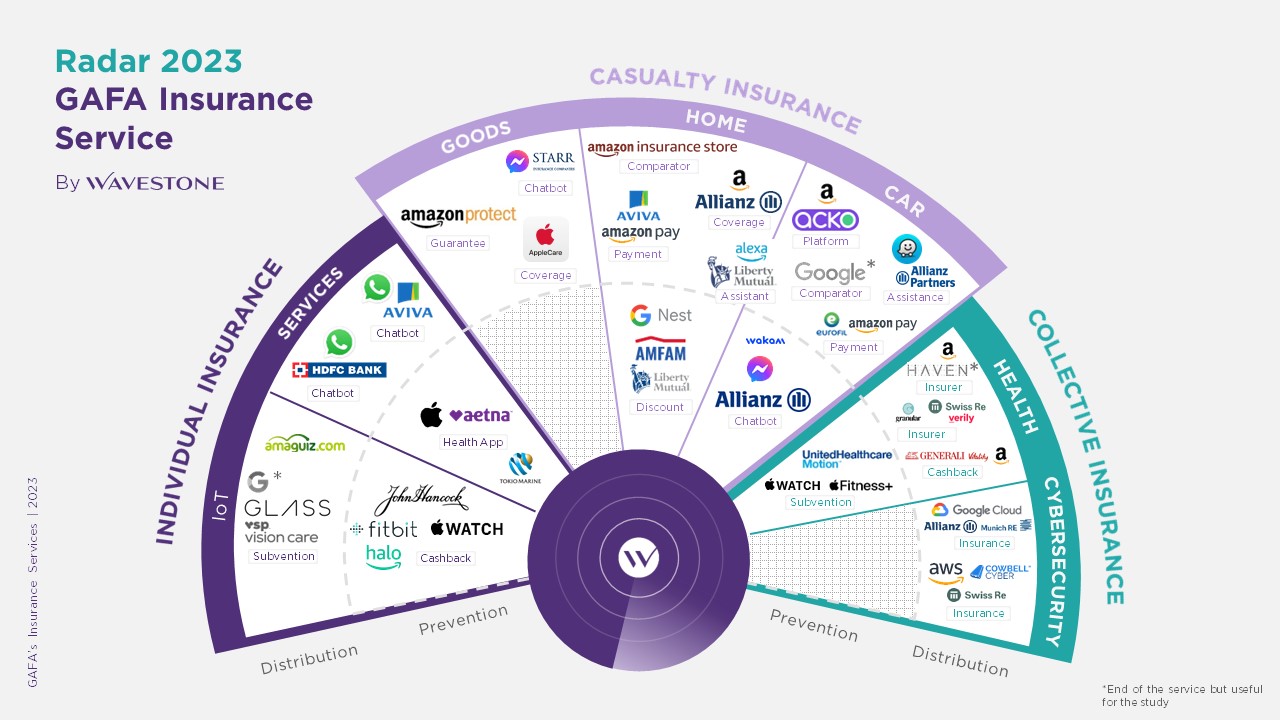

Introducing the first edition of the GAFA Insurance Services Radar. With this radar, we firmly believe that synergies with digital leaders present genuine opportunities for the property and personal insurance market, as they open up new perspectives for individuals and professionals in various insurance domains such as prevention, cashback, automotive, home, and cybersecurity.

Introduction

With a global total premium volume reaching $7.2 trillion (€6.7 trillion) in 2022, the insurance sector is highly attractive to GAFA. Consequently, partnerships between insurers and GAFA have been steadily increasing. Leveraging their technological power and data management capabilities, digital giants bring a competitive edge and a significant added value to traditional insurers who are facing challenges in digitizing and personalizing their offerings.

Despite numerous scandals and concerns related to personal data management, 30% of people worldwide are now inclined to turn to GAFA for insurance services. This figure has doubled since 2015 in North America and Europe.

While the impact of GAFA’s firepower may pose a threat to traditional players worldwide, in France, the latter remain the preferred insurers among consumers. Indeed, 48% of French individuals favor traditional insurers when considering health insurance contracts, while only 4% mention GAFA as a potential alternative.

Objectives and scope of the radar

This radar aims to analyze the evolution and entry strategies of GAFA into the insurance sector, while highlighting potential opportunities and advantages for traditional insurers to collaborate with GAFA.

The radar’s scope encompasses the following GAFA insurance offerings:

– Digital journeys or digital offers communicated in the press

– B2B and B2C offerings

– Global or region-specific offerings

After analyzing the various offerings provided by GAFA, five key insights emerge:

By offering premium reductions, cashback services, or other rewards based on customer behavior recorded by GAFA’s IoT (such as sports activities or sleeping habits), insurers can create more attractive offers.

Capitalizing on their digital platforms, GAFAs can accelerate customer journeys, provide insurance offer comparison tools, or facilitate the implementation of chatbots for insurers.

With a presence spanning across multiple regions and nearly all insurance segments (cybersecurity, health, automotive, etc.), the e-commerce giant is the most mature GAFA player in the sector thanks to various partnerships with insurers. With Google following closely behind.

The health sector allows GAFA to democratize their IoT devices (smartwatches, connected assistance devices…) and make it more accessible. Concurrently, insurers can collect a large amount of data to better prevent and accurately calculate the risks associated with their clients.

Nevertheless, GAFA face regulatory constraints that significantly impede their expansion in the market. Over the past few years, no fewer than five regulatory measures have been implemented in Europe and the United States to counter the overwhelming influence of GAFA, to regulate, and to ensure the use of user data.

Key figures

48%

of French individuals prioritize traditional insurers when considering health insurance contracts, while only 4% mention GAFA as a potential alternative

27

A total of 27 subsidiaries owned by GAFA directly impact the insurance sector

35

This study analyzes 35 insurance services offered by major digital players