With the release of the Digital Operational Resilience Act (DORA), the European Union is taking a strong stand to strengthen the financial sector’s resilience to ICT-related major incidents. With prescriptive requirements on both financial entities and critical ICT services provider, and an aggressive timeline for compliance (estimated at the end of 2022), organisations must start planning now.

Why Digital Operational Resilience Act (DORA)?

DORA is part of an EU-wide “Digital Finance Package”, aimed at making sure the financial sector can leverage opportunities brought by technology and innovation whilst mitigating the new risks associated. This package involves regulation on crypto assets, blockchain technology, and digital operational resilience.

With the Digital Operational Resilience Act, the EU aims to make sure financial organisations mitigate the risks arising from increasing reliance on ICT systems and third parties for critical operations. Organisations need to be able to “withstand, respond and recover” from the impacts of ICT incidents, thereby continuing to deliver critical and important functions and minimising disruption for customers and for the financial system. This means establishing robust measures and controls on systems, tools and third parties, having the right continuity plans in place, and testing their effectiveness.

This global, large scope regulation is coming in to rationalise an increasingly fragmented regulatory landscape on the topic, with a number of local regulatory initiatives in member states and smaller scope EU guidelines on related topics (e.g. testing requirements, management of ICT third party dependencies, cyber resilience). Setting up a global regulatory framework will ensure there are no overlaps or gaps in regulation and maintain good conditions for competition in the single market.

DORA also fits into a worldwide trend in regulation on resilience for the financial sector, pioneered by the Bank of England’s (FCA and PRA) consultation papers on operational resilience and impact tolerances, and followed by principle-based papers on operational resilience from the Bank of International Settlements (BIS) and the Federal Reserve.

DORA in a nutshell: what does it change?

Contrary to the FCA/PRA, the Federal Reserve and the BIS, DORA focuses on solely resilience to ICT-related incidents and introduces very specific and prescriptive requirements. It is not just a set of guidelines but rather criteria, templates and instructions that will shape how financial organisations manage ICT risk. It demonstrates that EU regulators want to be very hands-on on the topic, with a lot of reporting, communication and assessments that need to happen frequently, enabled by standardised MI and reporting.

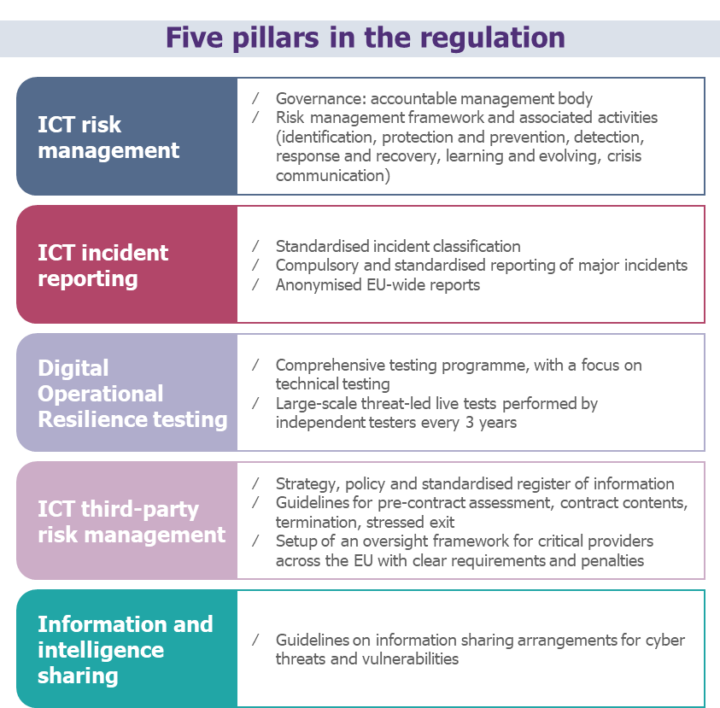

DORA introduces requirements across five pillars:

- ICT risk management

- ICT incident reporting

- Digital Operational resilience testing

- ICT third-party risk management

- Information and intelligence sharing

Some of the requirements are straight-forward and largely built on what is already being done in organisations (for example, the risk management framework that needs to be developed is similar to industry standards like NIST); but some are also challenging and will mean organisations need to launch some work to be compliant. We have summarised the requirements and these key challenges to start addressing now for each of the 5 pillars.

Why?

Ensure specific measures and controls are in place to limit the disruption to the market and to consumers caused by incidents, and ensure accountability of the management body on ICT risk management.

Key requirements

Firms will need to follow governance principles around ICT risk, with a focus on accountability of the management body. They will need to identify their risk tolerance for ICT risk, based on the risk appetite of the organisation and the impact tolerance of ICT disruptions. They will also need to have a risk management framework in place that includes identification of critical and important functions, risks associated and a mapping of the ICT assets that underpin them; as well as specific protection, prevention, detection, response and recovery plans and capabilities, continuous improvement processes and metrics, and a crisis communication strategy with clear roles and responsibilities.

Biggest challenge

As part of the continuous improvement processes, DORA introduces compulsory training on digital operational resilience for the management body but also for the whole staff, as part of their general training package.

Why?

Harmonise and centralise reporting of incidents to enable the regulator to react fast to avoid spreading of the impact, and to promote collective improvement and firms’ knowledge of current threats to the market.

Key requirements

DORA introduces a standard incident classification methodology with a set of specific criteria (number of users affected, duration, geographical spread, data loss, severity of impact on ICT systems, criticality of services affected, economic impact) with thresholds that are yet to be published. Following this methodology, incidents classified as major will have to be reported to the regulator within the same business day, following a certain template. Follow-up reporting will also be required after a week, and after a month. These reports will all be anonymised, compiled, and released regularly to the whole community.

Biggest challenge

Firms will need to change their incident classification methodology to fit with the requirements. They will also need to set up the right processes and channels to be able to notify the regulator fast in case a major incident occurs. Based on what gets classified as “major”, this might happen frequently. To help organisations prepare, we anticipate that the incident classification methodology will align with the ENISA Reference Incident Classification Taxonomy.

Why?

Ensure that financial entities test the efficiency of the risk management framework and measures in place to respond to and recover from a wide range of ICT incident scenarios, with minimal disruption to critical and important functions, in a way that is proportionate to their size and criticality for the market.

Key requirements

With DORA, all firms must put in place a comprehensive testing programme, including a range of assessments, tests, methodologies, practices and tools, with a focus on technical testing. The most critical firms will also have to organise a large-scale threat-led live penetration test every 3 years (red team type exercise), performed by independent testers, covering critical functions and services and involving EU-based ICT third parties. The scenario will have to be agreed by the regulator in advance and firms will receive a compliance certificate upon completion of the test. More guidance for these tests, as well as the criteria which defines a critical firm, will be published in 2021.

Biggest challenge

It is likely that critical firms will need to organise this threat-led penetration test by the end of 2024 and this type of test requires a lot of preparation. The fact that it needs to involve critical ICT third parties will also mean they need to be involved in the preparation. Firms that believe they will be in scope (might be firms already in the scope of NIS regulation) should start thinking about the scenario as soon as possible to enable validation with the regulator at least 2 years before the deadline.

Why?

Ensure that financial organisations have an appropriate level of controls and monitoring of their ICT third parties, especially the ones that underpin critical functions; and set up specific oversight on providers that are critical to the market as a whole.

Key requirements

With this regulation, the EU introduces requirements on both financial organisations and critical ICT providers.

- Financial organisations will need to have a defined multi-vendor ICT third-party risk strategy and policy owned by a member of the management body. They will need to compile a standard register of information that contains the full view of all their ICT third-party providers, the services they provide and the functions they underpin; and report on changes to this register to the regulator once a year. They will need to assess ICT service providers according to certain criteria before entering a contract (e.g. security level, concentration risk, sub-outsourcing risks), and they will need to plan for an exit strategy in case of failure of a provider. DORA also contains guidelines for contract contents and reasons for termination of contract, which has to be linked to a risk or evidence of non-compliance at the provider level.

- Under a new Oversight Framework, critical providers will be the subject of annual assessments against resilience requirements such as availability, continuity, data integrity, physical security, risk management processes, governance, reporting, portability, testing… These assessments will be performed directly by the regulator and will result in penalties for non-compliance.

Biggest challenge

Collating information on all ICT vendors (not only the most critical), with the services provided and functions they underpin for the register of information will be a very big task for large financial organisations that typically rely on thousands of big and small providers and legacy contract management systems that make it difficult to mine data from.

Why?

Promote sharing of information and intelligence on cyber threats between financial organisations to enable them to be better prepared.

Key requirements

DORA introduces guidelines on setting up information sharing arrangements between firms for cyber threats, including confidentiality requirements and the need to notify the regulator.

Biggest challenge

We do not see any particular challenge in this space as many organisations already have such agreements in place. It will be an opportunity to make local initiatives, networks or associations visible and encourage more companies to become part of them.

What happens next?

DORA is currently going through the EU legislative process and it is expected to take 6-12 months before it becomes law. A few questionable topics might lead to some debates and slow down the process, especially on third-party management: restrictive criteria for organisations to terminate contracts, banned non-EU based critical third parties, penalty system and financing of the Oversight framework by the critical providers. There are also details that still need to be published to clarify some of the requirements (e.g. templates, criticality criteria and thresholds…), which might also create some debates.

Once DORA is passed, firms should have one year to get into compliance with most of the requirements (i.e. probably by the end of 2022 – but this one-year deadline is short and we anticipate it may shift to 18 months following market feedback) and 3 years to organise a large-scale penetration test if required (i.e. probably by the end of 2024).

In order to be ready, we recommend organisations take the following steps in 2021:

- Perform a maturity assessment against the DORA requirements, with associated gap analysis and mitigation plan to reach compliance by the end of 2022

- Begin thinking about a scenario for the large-scale penetration test, aiming to get it validated by the regulator by mid-2022

- Start work on consolidation of the register of information for all ICT third party providers